6/24/2020

Britannia Industries Ltd (Britannia - NSE) - Updated EW count

Britannia Industries Ltd (Britannia - NSE) is in 5th subwave of 3rd wave up after 4th subwave ended in ABC zigzag correction in 2 hr time frame. 3rd internal wave is under progress for 5th subwave in 15 min time frame. It should hold the invalidation level to retain the count. In daily time frame it is in 5th wave.

Eicher Motors Ltd (Eichermot - NSE) - Updated EW count

Eicher Motors Ltd (Eichermot - NSE) has completed (B) wave and now going up in (C) in zigzag pattern from major low, which was actually a truncated low of down sequence as mentioned in previous updates. It is in 3rd wave up for (C) wave, which is quite sharp as reversal will be faster as predicted before, anyway now wait for wave 4 pull back to get in to trade. Equal size target is 20500.

HDFC Bank Ltd (Hdfcbank - NSE) - Updated EW count

HDFC Bank Ltd (Hdfcbank - NSE) is in subwave 3rd of 3rd wave major in ABC zigzag up move. (alternatively it can be end of WXY corrective up pattern, which is having low probability). The 4th subwave pull back will be scalping opportunity for trade in the trade setup . Next correction of wave 2 will be deciding factor for next big cycle.

Hero MotoCorp Ltd (Heromotoco - NSE) - Impulse wave pattern

Hero MotoCorp Ltd (Heromotoco - NSE) is in 3rd wave up of ABC zigzag wave pattern in2 hr time frame. It started 3rd subwave of 3rd wave up, which is supported by high volume, which will end only after small pull back and new high in 5 min time frame as indicated by red count. Stay in the cycle up until it invalidate the important level.

Hindalco Industries Ltd (Hindalco - NSE) - Updated EW count

Hindalco Industries Ltd (Hindalco - NSE) is in 3rd wave up of C wave. It is within 3rd subwave of 3rd wave up, which should be watched closely in 3 min time frame. Here C wave is getting extended as mentioned in earlier updates.

ICICI Bank Ltd (Icicibank - NSE) - Updated EW count

ICICI Bank Ltd (Icicibank - NSE) has completed 3rd of C up in ABC zigzag up move and it is correcting in 4th wave correction, which probably takes a day or two to complete. Thereafter 5th wave up will start to complete the cycle in C wave as WXY pattern.

Indian Oil Corporation Ltd (IOC - NSE) - Updated EW count

Indian Oil Corporation Ltd (IOC - NSE) has completed A wave up side and B wave correction is under progress, which is ABC zigzag in nature as mentioned in previous updates. It just completed a subwave and b subwave, wait to complete c subwave to end B wave. It completed major cycle down ABC in daily time frame and now correcting upside. The high volume in wave A will easily push up for C wave.

ITC Ltd (ITC - NSE) - Impulse wave pattern

ITC Ltd (ITC - NSE) has completed ABC zigzag downside as wave W in WXY down sequence and it is in the X wave up correction structure as ABC zigzag, where 4th subwave of C wave up is in progress. One more high will end the C and thereof X wave, so next cycle will be down Y wave. Wait for confirmation in 3 min time frame before get in to.

Larsen & Toubro Ltd (LT - NSE) - ABC wave pattern

Larsen & Toubro Ltd (LT - NSE) is in 4th wave of C wave up, so one more high will end the C wave of bigger WXY cycle in 2 hr time frame. Thereafter corrective down cycle will start. Wait for confirmation to get into.

Mahindra & Mahindra Ltd (M&M - NSE) - ABC wave pattern

Mahindra & Mahindra Ltd (M&M - NSE) has completed 3rd (or C wave) upside as indicated in chart and previous updates. It is now in 4th wave correction (or downside correction), which is ABC flat, so C wave will be good sell as it has so much divergence in indicator and new high with average volume for downside target of 5-8 % or higher.

Maruti Suzuki India Ltd (Maruti - NSE) - Impulse wave up

Maruti Suzuki India Ltd (Maruti - NSE) is in 5th wave up of C wave as indicated in chart. It is about to end the 5th wave as 4th subwave is in progress, which will end soon thereafter one more high will end the sequence. It may go up to 6200 level in that wave. Wait for clear count in 5 min time frame to get a new selling position.

Reliance Industries Ltd (Reliance - NSE) - Impulse wave pattern

Reliance Industries Ltd (Reliance - NSE) is in the 3rd wave up and near all time high. It is in the 5th subwave of 3rd wave, which will over with new high. Thereafter 4th down correction will start, which will give again buying opportunity for new 5th wave cycle.

6/23/2020

Nifty50 (Nifty - NSE) - Updated EW count

Nifty50 (Nifty - NSE) is in 4th wave correction of C wave of Y wave in WXY cycle up. The 4th wave can take one day to complete, so probably it ends tomorrow and start moving up again for 5th of C wave, which ends the uptrending correction.

Banknifty (Niftybank - NSE) - Updated EW count

Banknifty (Niftybank - NSE) is in 4th wave of C wave in Y wave, which is the part of WXY major correction. 4th wave will take a one day correction time to end, thereafter 5th wave will start. This is simple ABC zigzag within Y wave.

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) - Updated EW count

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) is within 5th subwave of 3rd wave up within diagonal structure or it may be within bigger extended wave 3 (if price crosses above 368). It is exactly moving as expected in earlier updates. It is the time to see that how the next move will be, because 4th wave will be good buy if the case. Until no trade zone.

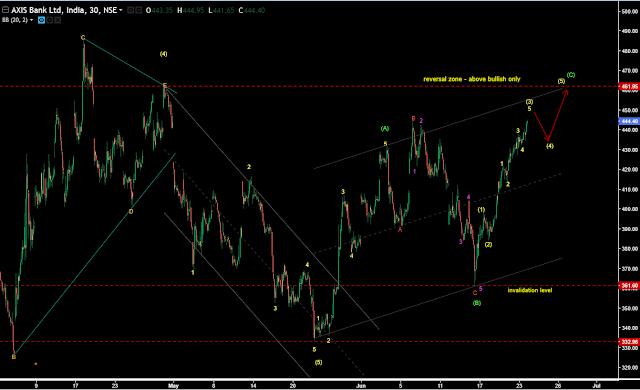

Axis Bank Ltd (Axisbank - NSE) - Updated EW count

Axis Bank Ltd (Axisbank - NSE) is in C wave up in ABC zigzag correction after B wave flat was ended. As expected in earlier updates that C wave up will be moving next, which is actually more stronger upmove. It is in 3rd wave up, which is about to end then 4th wave correction will start, which probably flat or triangle type correction as 3rd wave is very strong. Let’s see how chart moves next.

Bajaj Auto Ltd (Bajajauto - NSE) - Updated EW count

Bajaj Auto Ltd (Bajajauto - NSE) is in 3rd wave up of C wave in ABC zigzag up move in 2 hr time frame. It is in 3rd subwave of 3rd wave up in 30 min time frame. Stay bullish if you hold the position from previous update, until it hold the subwave 2 low of 2650.

Bajaj Finance Ltd (Bajajfin - NSE) - Updated EW count

Bajaj Finance Ltd (Bajajfin - NSE) is in 3rd wave of C wave up after it completed down sequence in 4 hr time frame. It is supported by huge volume as mentioned in previous updates and anybody followed previous update can gain about 20-30 % gain in the wealth with one trading week time. Anyway it is about to end the 3rd wave and then go down for 4th wave correction, thereafter again it will rise for one more high to complete the C wave.

Bajaj Finserv Ltd (Bajajfinsv - NSE) - Updated EW count

Bajaj Finserv Ltd (Bajajfinsv - NSE) is in 3rd wave of C wave up in ABC zigzag up move in 60 min time frame after massive drop. It is in the 3rd wave up, which will end soon and corrected down for 4th wave. Thereafter it will rise again to complete the C wave up. If anybody followed previous update and take aggressive entry then it will up about 20- 25 % up. It supported by huge volume, which is the main reason to rise faster.

Bharat Petroleum Corp Ltd (BPCL - NSE) - Updated EW count

Bharat Petroleum Corp Ltd (BPCL - NSE) is in 5th wave up of C wave, which is the part of ABC zigzag wave in 2 hr time frame. In 60 min time frame, it is going up in 5th wave, where it completed subwave 1 and going down for 2nd subwave, which will be good entry for new high to complete the C wave, but it must hold the invalidation level of 4th wave low 357 to retain the count.

6/17/2020

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) - Updated EW count

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) is moving up in 5th internal wave of subwave 3rd of 3rd wave as indicated in chart. As mentioned in previous updates it is going up in impulse and unless it retains above invalidation level, it is good buying candidate. In weekly time frame it is in 5th wave up.

Axis Bank Ltd (Axisbank - NSE) - Updated EW count

Axis Bank Ltd (Axisbank - NSE) is in C wave up as moving up in ABC zigzag pattern, Overall it is under-performer to Nifty index. Until it crossed down the B wave invalidation zone, it is a buy for C wave up. B wave was irregular extended flat correction, which probably should result in sharp C wave up. Once it crossed above reversal zone, it will be within strong buying cycle. Let’s see how it moves next.

Bajaj Auto Ltd (Bajajauto - NSE) - Updated EW count

Bajaj Auto Ltd (Bajajauto - NSE) is in 3rd wave of C up after 2nd wave was over. The 2nd wave low should hold to be in 3rd wave, wait for upper trend line as resistance to cross upside as confirmation of up trend to get in to.

Bajaj Finance Ltd (Bajajfin - NSE) - Updated EW count

Bajaj Finance Ltd (Bajajfin - NSE) is in B wave zigzag correction after impulse wave A up was over from last major bottom. B wave can take a day or two to complete and thereafter C wave up will start. In weekly time frame it completed impulse up wave at top and now correcting in ABC cycle up. A relative high volume is good supporter to price moving up, which came after major low.

Bajaj Finserv Ltd (Bajajfinsv - NSE) - Updated EW count

Bajaj Finserv Ltd (Bajajfinsv - NSE) is in B corrective wave, which is turnout to be sharp zigzag as mentioned in previous update after price rise in impulse wave A. It completed bigger impulse (A) wave down and now correcting the drop in (B) wave, which possibly complex correction. A relative high volume is good supporter to price moving up, which came after major low.

Bharat Petroleum Corp Ltd (BPCL - NSE) - Updated EW count

Bharat Petroleum Corp Ltd (BPCL - NSE) is within 4th wave ABC correction after wave count updates. One more high will complete (A)(B)(C) zigzag pattern from last major bottom in 2 hr time frame. The C wave of 4th wave was diagonal structure, which indicates the sharp 5th wave rise is on the way till it holds above the low of C wave of 4th wave.

Bharti Airtel Ltd (Bhartiartl - NSE) - Updated EW count

Bharti Airtel Ltd (Bhartiartl - NSE) is in B wave of (Y) wave cycle as expected in earlier updates. The internal c wave of B wave in flat correction is under progress, which once over thereafter C wave will start moving down to complete the (Y) wave down. It may turn out to be impulse pattern too. As previously mentioned it in under bearish cycle. Let’s see how it moves next.

Britannia Industries Ltd (Britannia - NSE) - Updated EW count

Britannia Industries Ltd (Britannia - NSE) is in 5th subwave of 3rd wave up after 4th subwave ended in ABC zigzag correction. One more high will complete the 3rd wave. It should hold the invalidation level to retain the count. In daily time frame it is in 5th wave.

Cipla Ltd (Cipla - NSE) - Updated EW count

Cipla Ltd (Cipla - NSE) is in completed correction pattern WXY, in which wave Y is under progress. In 2 hr time frame, it is in ABC zigzag pattern up. The C wave may be over or it may extend further. From daily time frame, it is clear that it may extend the C wave, so after Y wave ends in 15 min time frame, it is possible to go higher in wave 3 of C. Will analyze later as price progresses.

Eicher Motors Ltd (Eichermot - NSE) - Updated EW count

Eicher Motors Ltd (Eichermot - NSE) is in 2nd wave of C wave up in ABC zigzag pattern after 5th wave of (C) ended down in truncation as mentioned in previous updates. The 2nd wav will go down for c internal wave completion, thereafter 3rd wave will move up. Equal size C wave will end around 20500 level. So good risk reward ratio trade set up. Wait the turn out point after 2nd wave over to confirm the uptrend.

Gail Ltd (Gail - NSE) - Updated EW count

Gail Ltd (Gail - NSE) has completed ABC zigzag correction and now correcting in WXY correction in double zigzag. In weekly time frame it complete downside WXY wave. Now its started new up cycle. No more updates on Gail until it converts in to next trend.

HDFC Bank Ltd (Hdfcbank - NSE) - Updated EW count

HDFC Bank Ltd (Hdfcbank - NSE) is in 2nd wave of C (or 3rd wave) up. 2nd wave unfolding in wxy complex correction, thereafter 3rd wave will start up. Wave x is moving up which may end soon to start y wave down for 2nd wave. In weekly time frame it is in 5th wave (or 4th wave correction).

Hindalco Industries Ltd (Hindalco - NSE) - Updated EW count

Hindalco Industries Ltd (Hindalco - NSE) is in 3rd wave up of C wave. It has completed 2nd wave in zigzag move. The 2nd subwave of 3rd wave up is under progress, which ends soon and 3rd subwave will again rise upward as indicated in chart.

ICICI Bank Ltd (Icicibank - NSE) - Updated EW count

ICICI Bank Ltd (Icicibank - NSE) is B wave, which is complex correction wxy and x wave is under progress. Wait to complete y wave of B wave to get in for wave C up. The overall cycle is in WXY correction.

Indian Oil Corporation Ltd (IOC - NSE) - Updated EW count

Indian Oil Corporation Ltd (IOC - NSE) has completed A wave up side and B wave correction is under progress, which is ABC zigzag in nature as mentioned in previous updates. It just completed a subwave and b subwave is in progress, wait to complete c subwave to complete B wave. It completed major cycle down ABC in daily time frame and now correcting upside. The high volume in wave A will easily push up for C wave.

Mahindra & Mahindra Ltd (M&M - NSE) - ABC wave pattern

Mahindra & Mahindra Ltd (M&M - NSE) has completed ABC zigzag from major bottom in 2 hr time frame as expected in previous updates. It may possible that whole move up will be impulse. So wait for next correction quality to turns out to be impulse or corrective. Wave 2nd was flat, so 4th wave will possibly triangle or complex, if it has to be completed within subwave 4th of 3rd wave. Let’s see what happened next. If it completes in the top part of 3rd wave, then it will be good buy. The high volume may easily take it up for new high.

6/10/2020

Nifty50 (NSEI - NSE) - Updated EW count

Nifty50 (NSEI - NSE) is in 4th wave of wave A in ABC move up for Y wave, which will possibly sharp down as 2nd wave was irregular correction. In weekly time frame from 2009 low, price going up in impulse wave and currently wave 5 is in progress. In 60 time frame the up move is corrective, said zigzag kind of move, which suggest the ending diagonal move will be on the way to 5th wave.

Banknifty (NSEBANK - NSE) - Updated EW count

Banknifty (NSEBANK - NSE) is in new up cycle from last higher low dated 22 May as mentioned in last updates. It completed wave A (or 1) and now correcting down in B (or 2) wave down in flat correction. In weekly time frame from 2009 major low, it is in ABC up cycle and price has completed its 4th wave correction down of C wave up, means next wave will be 5th up, which may be started, which confirm when price is moving above previous 4th wave of C wave down as line of reversal and moving up in impulse.

Nifty Midcap 50 (NIMDCP50 - NSE) - ABC wave pattern

Nifty Midcap 50 (NIMDCP50 - NSE) is in 4th wave correction of wave C up in ABC zigzag pattern. This index is having clear count than Nifty as wave A was five wave clear pattern. 4th wave is moving down more to complete it and thereafter 5th wave up will start may be tomorrow as other indices have to complete their waves. In weekly time frame, it is in corrective move up as indicated in chart. This is new up cycle from last low.

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) - Updated EW count

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) is extending its 3rd wave and within 4th subwave of 3rd wave as indicated in chart as expected in previous updates. It will go for C wave down to complete 4th subwave, thereafter make a new high. In weekly time frame it is in 5th wave up.

Axis Bank Ltd (Axisbank - NSE) - Updated EW count

Axis Bank Ltd (Axisbank - NSE) is now in wave C up from truncated bottom, where it completed previous wave. It is in 2nd wave down of C and can take more time, alteratively it may be wave B correction as Nifty is within wave 4. Once it crossed above reversal zone, it will be within strong buying cycle.

Bajaj Auto Ltd (Bajajauto - NSE) is in C wave up and 2nd wave is in progress as flag pattern. It may take a while to complete, thereafter wave 3 will start moving up.

Bajaj Finance Ltd (Bajajfin - NSE) - Updated EW count

Bajaj Finance Ltd (Bajajfin - NSE) has completed wave A from bottom in impulse sequence and crossed above reversal zone, which indicated its down cycle was over. Wait for B wave to complete in zigzag to start new C wave up cycle. In weekly time frame it completed impulse up wave at top and now correcting in ABC cycle up.

Bajaj Finserv Ltd (Bajajfinsv - NSE) - ABC wave pattern

Bajaj Finserv Ltd (Bajajfinsv - NSE) is in B corrective wave after price rise in impulse wave A. It completed bigger impulse (A) wave down and now correcting the drop. Wait for B wave to complete in sharp correction.

Bharat Petroleum Corp Ltd (BPCL - NSE) - Updated EW count

Bharti Airtel Ltd (Bhartiartl - NSE) - Updated EW count

Bharat Petroleum Corp Ltd (BPCL - NSE) has completed 3 subwave of 3rd of C wave up and correcting down in 4th subwave in sharp correction. Thereafter will go for final move of 3rd wave. This ABC is the part of correction in bigger time frame.

Bharti Airtel Ltd (Bhartiartl - NSE) - Updated EW count

Bharti Airtel Ltd (Bhartiartl - NSE) it has completed X wave as expected in earlier updates. Now it is moving down in wave A and 3rd wave is under progress down. It will be moving down in WXY wave and Y wave down in ABC is under progress. As previously mentioned it in under bearish cycle.

Britannia Industries Ltd (Britannia - NSE) - Updated EW count

Britannia Industries Ltd (Britannia - NSE) is in 4th subwave of 3rd wave up in impulse sequence as earlier mentioned in updates, which is actually overall 5th wave up in daily time frame. One more high will complete the 3rd wave.

Cipla Ltd (Cipla - NSE) - Updated EW count

Cipla Ltd (Cipla - NSE) is in ABC zigzag wave pattern in 60 min time frame. It is in 2nd wave sharp correction after impulse 1st wave over of C cycle. 2nd is taking time of one or two to complete and afterward headed up for 3rd wave. In weekly time frame, it completed down side WXY correction after impulse up over.

Eicher Motors Ltd (Eichermot - NSE) - Updated EW count

Eicher Motors Ltd (Eichermot - NSE) is in corrective B wave of up cycle move, which might take more time to complete. Thereafter wave C up will start. It has completed down sequence in truncation of 5th wave of C wave. So up move might be sharper upside.

Gail Ltd (Gail - NSE) - Updated EW count

Gail Ltd (Gail - NSE) is in 4th wave of C wave up, which is about to over and 5th wave will start soon. The volume is very high, which indicates the one more high will be highly probable. In weekly time frame it complete downside WXY wave. Now its started new up cycle.

HDFC Bank Ltd (Hdfcbank - NSE) - Updated EW count

HDFC Bank Ltd (Hdfcbank - NSE) is in 2nd wave of C (or 3rd wave) up. 2nd wave might take more time to complete, but after that 3rd wave will start up, which should move sharply up as it has high volume support. In weekly time frame it is in 5th wave (or 4th wave correction).

Hindalco Industries Ltd (Hindalco - NSE) - Updated EW count

Hindalco Industries Ltd (Hindalco - NSE) is in 2nd wave of C wave up and take up more time to complete. 3rd wave will start once 2nd over. It is in ABC zigzag move up.

ICICI Bank Ltd (Icicibank - NSE) - Updated EW count

Mahindra & Mahindra Ltd (M&M - NSE) - ABC wave pattern

ICICI Bank Ltd (Icicibank - NSE) is B wave, which again in flat abc correction. The c of B is impulse and complete when five wave over, thereafter C wave up will start moving up in Y wave. The overall cycle is in WXY correction.

Indian Oil Corporation Ltd (IOC - NSE) - Updated EW count

Indian Oil Corporation Ltd (IOC - NSE) has completed A wave up side and B wave correction is under progress, which highly likely sharp in nature. It completed major cycle down ABC in daily time frame and now correcting upside. The high volume in wave A will easily push up for C wave.

ITC Ltd (ITC - NSE) - Updated EW count

ITC Ltd (ITC - NSE) is in 2nd wave correction of wave C up, which take about 2 days to complete in flat correction. In weekly time frame it is in 5th wave up, which is either impulse or diagonal structure. So if we consider it in impulse then in 60 min time frame, it is in 3rd wave, where internal 1st wave is over and correcting down for 2nd wave. But if we consider the diagonal structure then 1st wave as ABC over and 2nd wave is in progress. In both scenario, price will go further up after correction. So watch the quality of correction to have clear idea about to next move up.

Nestle India Ltd (Nestleind - NSE) - Updated EW count

Nestle India Ltd (Nestleind - NSE) is in strong uptrend in all time frame as well as out-performer to Nifty index. It is about to end 2nd wave correction and will start 3rd wave up. The invalidation level must hold to confirm the thesis.

Mahindra & Mahindra Ltd (M&M - NSE) - ABC wave pattern

Mahindra & Mahindra Ltd (M&M - NSE) is in ABC zigzag from bottom and correcting in 4th wave of C wave up (or 3rd wave). In weekly time frame, it has completed downside complex correction and going up in either new corrective cycle or impulse 5th wave. Let’s see what happened next.

Maruti Suzuki India Ltd (Maruti - NSE) - Impulse wave up

Maruti Suzuki India Ltd (Maruti - NSE) is in 4th subwave comp;ex correction of 3rd wave up (or C wave). The high volume supports the up move. In weekly time frame, it completed downside 4th wave correction and now moving up in 5th wave up or new corrective cycle.

6/3/2020

Nestle India Ltd (Nestleind - NSE) - Impulse wave pattern

Nestle India Ltd (Nestleind - NSE) is in strong uptrend in all time frame as well as out-performer to Nifty index. It is now moving up in 3rd internal of 3rd wave up with relative high volume. In weekly time frame it in the 5th internal of 3rd wave of C cycle up. The invalidation level must hold to confirm the thesis.

ITC Ltd (ITC - NSE) - Impulse wave pattern

ITC Ltd (ITC - NSE) is ABC zigzag wave pattern in 60 min time frame. 5th wave of C is completed so correction is under play. In weekly time frame it is in 5th wave up, which is either impulse or diagonal structure. So if we consider it in impulse then in 60 min time frame, it is in 3rd wave, where internal 1st wave is over and correcting down for 2nd wave. But if we consider the diagonal structure then 1st wave as ABC over and 2nd wave is in progress. In both scenario, price will go further up after correction. So watch the quality of correction to have clear idea about to next move up.

6/2/2020

Nifty50 (NSEI - NSE) - ABC wave pattern

Nifty50 (NSEI - NSE) is in 3rd wave of C wave up, which is about to end soon. Wave A is the part of ABC pattern of Y wave up as shown in chart. In weekly time frame from 2009 low, price going up in impulse wave and currently wave 5 is in progress. In 60 time frame the up move is corrective, said zigzag kind of move, which suggest the ending diagonal move will be on the way to 5th wave.

Banknifty (NSEBANK - NSE) - ABC wave pattern

Banknifty (NSEBANK - NSE) is in new up cycle from last higher low dated 22 May. The price has made impulse move up as A wave, which is about to end soon and then wave B correction will start moving down. In weekly time frame from 2009 major low, it is in ABC up cycle and price has completed its 4th wave correction down of C wave up, means next wave will be 5th up, which may be started, which confirm when price is moving above previous 4th wave of C wave down as line of reversal. Adani Port & Special Economic Zone Ltd (Adaniport - NSE) - Impulse wave pattern

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) is extended 3rd wave up from bottom in 60 min time frame. The price action is within up trending channel with overlapping swings, so it is hard to pinpoint the clear waves, so it is better to know invalidation point of impulse character instead wave count. In weekly time frame it is in 5th wave up. (Refer chart update - 5/28/2020)

Axis Bank Ltd (Axisbank - NSE) - Updated EW count

Axis Bank Ltd (Axisbank - NSE) has completed 5th wave of C at last higher bottom as truncationm, which only confirmed when price once moving up the reversal zone. In weekly time frame it completed impulse up move and now correction ABC down cycle is about to over then new up cycle will start, which might be ABC or impulse. (Refer chart update - 5/28/2020)

Bajaj Auto Ltd (Bajajauto - NSE) - ABC wave pattern

Bajaj Auto Ltd (Bajajauto - NSE) is in ABC zigzag wave pattern in 60 min time frame. Price is within B wave corrective was triangle. 1st wave of C up started moving up and about to end soon, thereafter wave 2nd will come down. (Refer chart update - 5/28/2020)

Bajaj Finance Ltd (Bajajfin - NSE) - New up cycle

Bajaj Finance Ltd (Bajajfin - NSE) has completed ABC down cycle and moved up above reversal zone, means new up cycle now started with relative high volume. It may be in 3rd wave, but until the wave will be clear giving sign of what happened next, no trading opportunity there. In weekly time frame it completed impulse up wave at top and now correcting in WXY cycle. (Refer chart update - 5/28/2020)

Bharat Petroleum Corp Ltd (BPCL - NSE) is in ABC zigzag wave pattern and price is now in 3rd internal of 3rd of C wave up as shown in chart. It is extending move by subdividing in to smaller waves. This ABC is the part of correction in bigger time frame.(Refer chart update - 5/28/2020)

Bharti Airtel Ltd (Bhartiartl - NSE) - ABC wave pattern

Bharti Airtel Ltd (Bhartiartl - NSE) has completed ABC zigzag down correction as the part of WXY down side correction after completed its up cycle. It is now moving up in X wave as ABC wave pattern. It is now in down cycle, so bearish outlook continue on stock. (Refer chart update - 5/28/2020)

Britannia Industries Ltd (Britannia - NSE) - Impulse wave up

Britannia Industries Ltd (Britannia - NSE) is in 3rd wave up of impulse in 60 min time frame, which is actually overall 5th wave up in daily time frame. It is in 3rd internal of 3rd wave up. (Refer chart update - 5/28/2020)

Cipla Ltd (Cipla - NSE) - ABC wave pattern

Cipla Ltd (Cipla - NSE) is in ABC zigzag wave pattern in 60 min time frame, in which price is moving up in wave C as 3rd wave up as subdivision. The move up is supported by huge volume. In weekly time frame, it completed down side WXY correction after impulse up over. (Refer chart update - 5/28/2020)

Eicher Motors Ltd (Eichermot - NSE) - Impulse wave pattern

Eicher Motors Ltd (Eichermot - NSE) is completed down impulse as C wave of daily time frame as truncated 5th wave as shown in chart. After that it crosses up above reversal zone and confirmed new cycle started up, which is about to end with new high as impulse wave. (Refer chart update - 5/28/2020)

Gail Ltd (Gail - NSE) - ABC zigzag wave pattern

Gail Ltd (Gail - NSE) is in ABC zigzag and moving up in 3rd wave of C up, which is zigzag and within channel and hard to exactly pin point the smaller wave, so wait till bigger correction, but its moving up as expected with larger volume. In weekly time frame it complete downside WXY wave. Now its started new up cycle. (Refer chart update - 5/28/2020)

HDFC Bank Ltd (Hdfcbank - NSE) - ABC flat wave pattern

HDFC Bank Ltd (Hdfcbank - NSE) is in ABC flat wave pattern and moving up in 3rd wave of C, which is about to end if not further extends. (Refer chart update - 5/28/2020)

Hindalco Industries Ltd (Hindalco - NSE) - ABC zigzag wave pattern

Hindalco Industries Ltd (Hindalco - NSE) is in ABC zigzag wave pattern in 60 min time frame from major low and it is now in 1st of C wave up with relative high volume, which is about to end with one more high. Wave 2nd will be good entry for C up. (Refer chart update - 5/28/2020)

ICICI Bank Ltd (Icicibank - NSE) - WXY wave pattern

ICICI Bank Ltd (Icicibank - NSE) is in WXY pattern from low made in mid march in 60 min time frame. It is now in ABC sharp zigzag wave up as Y wave. A is about to end and B wave dip will be coming as good entry for C wave up. (Refer chart update - 5/28/2020)

5/28/2020

Infosys Ltd (Infy - NSE) - WXY wave pattern

Infosys Ltd (Infy - NSE) is in WXY complex corrective pattern moving in up in 60 min time frame. It is now in B wave down of Y degree as ABC wave. After B wave completion C wave will go upward. I thas completed flat down sequence in daily time frame as A wave in weekly and now moving up in B wave. Here Y in 60 min time frame may be divided in further wxy as double complex correction because W & X are simple ABC correction.

Indian Oil Corporation Ltd (IOC - NSE) - Impulse over

Indian Oil Corporation Ltd (IOC - NSE) has completed C wave down as impulse as shown in 60 min chart as the part of ABC sequence of Y wave in Daily time frame. In 60 min 5th wave of C down was completed and price reversed and moving up now. But wait for confirmation as level of invalidation to cross above the level of 89.50, which is the part of new up trending cycle of intermediate degree.

5/27/2020

ICICI Bank Ltd (Icicibank - NSE) - WXY wave pattern

ICICI Bank Ltd (Icicibank - NSE) is in WXY pattern from low made in mid march in 60 min time frame. It has completed wave X in ABC sharp zigzag wave and now moving in Y wave up. Wait for clear wave structure to get in to trade. A huge volume added in X wave down, which can fueling the Y wave up. In weekly time frame it has completed impulse up and now correcting in ABC wave pattern.

Hindalco Industries Ltd (Hindalco - NSE) - ABC zigzag wave pattern

Hindalco Industries Ltd (Hindalco - NSE) is in ABC zigzag wave pattern in 60 min time frame from major low and it is now in 1st of C wave up, which is about to end. In weekly time frame it in in choppy WXY wave pattern and completed downside correction. Wave 2nd will be good entry for C up.

HDFC Bank Ltd (Hdfcbank - NSE) - ABC flat wave pattern

HDFC Bank Ltd (Hdfcbank - NSE) is in ABC flat wave pattern and moving up in 3rd wave of C. In weekly time frame it looks in strong uptrend and outperforming Nifty. It may possible that it start new impulse from bottom in 60 min time frame but its early to say anything until we have any confirmation so better to mark as ABC up

Gail Ltd (Gail - NSE) is in ABC zigzag wave pattern in 60 min time frame from last bottom. Wave A was in leading diagonal, which means wave C will be going much higher. Wave B has completed in sharp and wave C is already moved up, which is in 2nd wave and will over any time soon. In weekly time frame it complete downside WXY wave. Now its started new up cycle.

Eicher Motors Ltd (Eichermot - NSE) - Impulse wave pattern

Eicher Motors Ltd (Eichermot - NSE) is completed down impulse as C wave of daily time frame as short 5th wave as shown in chart. In weekly time frame it has completed down ABC cycle correction after monthly impulse over two years ago. Now price is in up cycle against ABC down move. Wait for clear wave to decide what will happened next.

Cipla Ltd (Cipla - NSE) is in ABCzigzag wave pattern in 60 min time frame, in which price is moving up in wave C as 2nd wave correction, which is about to over with one more dip. After 3rd wave up of C will start. The move up is supported by huge volume. In weekly time frame, it completed down side WXY correction after impulse up over. It may possible to go up in another Impulse, but in early stage it is better to count ABC rather than impulse.

Britannia Industries Ltd (Britannia - NSE) - Impulse wave up

Britannia Industries Ltd (Britannia - NSE) is in 3rd wave up of impulse 5th wave up in daily time frame. It just started moving up in 3rd of 3rd wave up in 60 min time frame. In weekly time frame its a strong stock, which is most out-performer to Nifty and its price action upside was supported with huge volume. It should just stay above invalidation level.

Bharti Airtel Ltd (Bhartiartl - NSE) - ABC wave pattern

Bharti Airtel Ltd (Bhartiartl - NSE) is in ABC wave pattern as zigzag moving downside after completing c of y wave upside in daily time frame. It is in 4th wave of c down in 30 min time frame with life time bigger volume, which indicates the end of temporary trend upside and in the C wave down it will probably fill the downside gap which created by 5th wave. In weekly time frame its choppy and no need to count the waves.

Bharat Petroleum Corp Ltd (BPCL - NSE) - ABC wave pattern

Bharat Petroleum Corp Ltd (BPCL - NSE) is in ABC zigzag wave pattern and price is now in 3rd internal of 3rd of C wave up as shown in chart. This ABC is the part of correction in bigger time frame. In weekly time frame it completed Y wave on top of chart and now correcting in down sequence as WXY complex correction and price now in Y wave down as internal wxy.

Bajaj Finance Ltd (Bajajfin - NSE) - ABC wave pattern

Bajaj Finance Ltd (Bajajfin - NSE) is in ABC wave pattern from last top shown in chart. Wave B was triangle and c is going to form ending diagonal, which means next upmove will be sharp up. This ABC is the part of bigger WXY cycle,where W ends and X up wave will starts. In weekly time frame it completed impulse up wave at top and now correcting in WXY cycle.

Bajaj Auto Ltd (Bajajauto - NSE) - ABC wave pattern

Bajaj Auto Ltd (Bajajauto - NSE) is in ABC zigzag wave pattern in 60 min time frame. Price is within B wave corrective as triangle till it holds invalidation level. C wave once will be confirmed when triangle broken out upside. In weekly time frame, it was choppy in up move, but in down cycle it was ABC flat correction, which was over.

Axis Bank Ltd (Axisbank - NSE) - Impulse wave pattern

Axis Bank Ltd (Axisbank - NSE) is in C wave down in daily time frame and in 60 min time frame it is going down to 5th wave of C. It is now in 4th wave correction of 5th of C, which is about to over with minor new high in 10 min time frame. In weekly time frame it completed impulse up move and now correction ABC down cycle is about to over then new up cycle will start, which might be ABC or impulse.

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) is in 4th of 3rd wave up from bottom in 60 min time frame. C leg down will start soon for 4th wave after which it will again go up for final wave in 3rd up. In weekly time frame it is in 5th wave up. It is also out-performing Nifty index as a plus point to bullish side. The price action is within up trending channel with overlapping swings, so it is hard to pinpoint the clear waves, so it is better to know invalidation point of impulse character instead wave count.

5/22/2020

Cipla Ltd (CIPLA - India) - Updated EW count

Cipla Ltd (CIPLA - India) is in 5th wave of 1st wave of C up as shown in chart. After completing wave 1, wave 2 correction will be deeper.

ICICI Bank (ICBK - India) - Updated EW count

ICICI Bank (ICBK - India) is 5th of 5th wave which will be three wave in nature as the part of ending diagonal structure, which will strong change in trend as indicator.

5/19/2020

Cipla Ltd (CIPLA - India) - ABC zigzag pattern

Cipla Ltd (CIPLA - India) is in ABC from major bottom as shown chart. After strong A wave, price just giving B wave flat within upper 24% area. Now wave C is started with relative high volume & also break the resistant trend line, which go for next new high with high possibility, until invalidation area should not be breached.

CIPLA Weekly time frame shown in Log scale.