Hello Traders & EW Analyst,

We are happy to announce that, CycleWave launched the Discord server one month ago to share trading ideas based on Elliott wave principles. Discord is the great platform to organize every trading ideas across different segments like crypto-currencies, currency pairs, commodities, major future indices & stock markets, which is similar to what's App or telegram, but having more functionality than both having both mobile and desktop versions for easy accessment.

All the trading ideas are separated in such a way that you can access current as well as historical analyses of each instruments at any time on your electronic devices like laptop, mobile phones or desktop with ease. You will notified for every updates on your mobile phones, so that you never missed anything, which you don't want to.

Discord server is a complimentary service started by CycleWave, which provide the great all in one platform to access different stock markets at one place like US, German, Hang Seng, India, UK and many more. Users can directly interact with us on chat as well or with other users of the server to discuss or share the trading ideas, news and views. Discord is similar platform like Telegram, but having more features to mange and retrieve the data very easily.

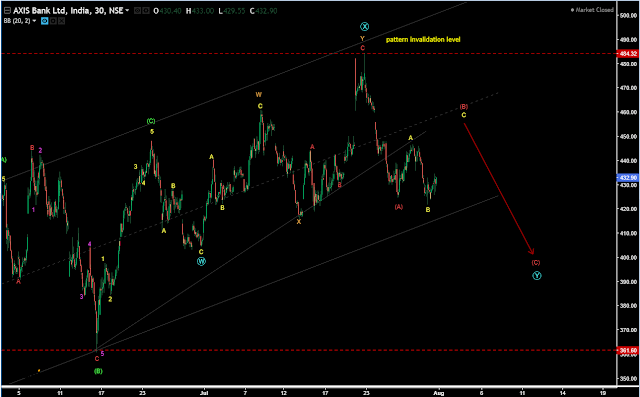

In Discord updates, every instruments are analysed in minimum 30 min time frames on daily basis so that traders & analysts both find swing & daily trade set ups. Other than 30 min weekly and daily time frame analyses also included to pin point the major trend across any instruments. Stocks (all markets) updates once in a week, while cryptos, currency pairs, commodities and major future indices are updates on daily basis. So you can click here to find your invitation link.

Some Screen shots attached to give the sense of Discord platform, that how it works.

How many segments included in Discord ? - You can check the screen shot of Discord community server to get idea. As mentioned Cryptos, currency pairs, commodities, major future indices, stocks from US, Germany, India, Heng Seng etc & trader's point.

How many crypto currency included to Discord ? You will get daily updates on Bitcoin, Ethereum, Litecoin, Chainlink, BandTetherUS, EOSUSDT initially.

How many currency pairs included to Discord ? - All major currency pair including USDollar, EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDMXN, USDCHF, JPYEUR, EURGBP & USDINR. Major of them updated on daily basis.

How many commodities included to Discord ? - All metals including Gold, Silver, Platinum, Palladium, Copper, Aluminum, Nickel, Zinc, Energy including Crude oil, Gasoline, Heating oil, Natural gas, Grains including Wheat, Corn, Soybean and Softs like Cotton, Cocoa, Coffee and Sugar, which are all updated alternatively.

How many market indices and futures added in Discord ? US , European and Asian indices and respective futures added including US sectors.

How many US stocks included in Discord ? Top 50 large cap stocks including hot stocks in up and down trend.

How many German stocks included in Discord ? Around 40 major German stocks & sectors are included for analyses.

How many Indian stocks included in Discord ? Top 100 nifty stocks by volume & nifty sectors are included for analyses.

How many Heng Seng stocks included in Discord ? Around 30 stocks & sectors are included for analyses.

How different users can interact at Trader’s point ? - Every users can interact with other users at Trader’s point to share ideas, news and views under separate pages set for different segments to make it more interesting rather than annoying. No users can allowed to post any messages under the daily updates, which makes it more attractive and clean to study.

Here is your invitation link to join CycleWave on Discord.