Join CycleWave at Discord community to get more exciting trade ideas for free. Now on wards no more updates available on the blog. So click here to join Discord.

Nifty midcap50 (Niftymidcap50 - NSE) - It is in choppy correction and will possibly go upward in abc correction for either (X) wave or 5th subwave as extension (which considered low probability). So stay slight bullish and get in to three wave pull back after confirming a wave.

Axis Bank Ltd (Axisbank - NSE) - Choppy but slight bullish

Bharti Airtel Ltd (Bhartiartl - NSE) - choppy but bearish price action

To view the historical analyses of Nifty50 & stocks, click here.

8/1/2020

Nifty50 (Nifty - NSE) - It is choppy in correction as WXY, where X wave up is in progress, so stay bullish and trade for small targets. It is possible to make new high within correction. The trading range for next week will be around 11100-11500.

Nifty Bank (Banknifty - NSE) - The choppy abc correction downside seems over, where 5th of 5th down might be truncated. Gap down will end that wave, so it would be considered good buy with stops below day low (if done on Monday). Possible price action will be choppy ABC, so stay slight bullish.

Nifty midcap50 (Niftymidcap50 - NSE) - It is in choppy correction and will possibly go upward in abc correction for either (X) wave or 5th subwave as extension (which considered low probability). So stay slight bullish and get in to three wave pull back after confirming a wave.

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) - Bulls takes control

Adani Port & Special Economic Zone Ltd (Adaniport - NSE) has completed ABC flat correction down, where C was extended cycle. It is now in ABC up cycle, where A impulse and B corrective finished. So stay long with stops below 310 for target up to 330-36 zone.

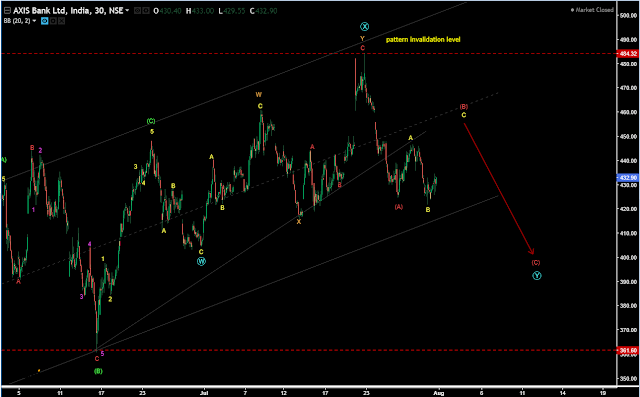

Axis Bank Ltd (Axisbank - NSE) - Choppy but slight bullish

Axis Bank Ltd (Axisbank - NSE) is in ABC correction, where B wave is in progress and c of B will probably go up, so sell near 450-65 zone for C wave down, when B wave gets finished. It is overall under-performer stock to Nifty.

Bajaj Auto Ltd (Bajajauto - NSE) - Choppy price action

Bajaj Auto Ltd (Bajajauto - NSE) is in corrective mode as ABC cycle. So it will start B wave soon. Stay bearish when it over for C wave down. It can turn into more complex correction as WXY. So wait for confirmation.

Bajaj Finance Ltd (Bajajfin - NSE) - Choppy to bullish price action

Bajaj Finance Ltd (Bajajfin - NSE) has completed ABC sequence down in 30 min time frame as W wave and now correcting up in X wave, where c wave will start soon. So it may be possible to make new high in X wave, so stay long with stops below 3183.50 for target of around 3430 or higher..

Britannia Industries Ltd (Britannia - NSE) - Choppy correction - Bulls will take control

Britannia Industries Ltd (Britannia - NSE) is in choppy ABC correction, where B wave is in progress, so wait for C to over at around 3700 level to get in for long trade for 5th wave up move for target above 4050 - 4150 level.

Bharti Airtel Ltd (Bhartiartl - NSE) - choppy but bearish price action

Bharti Airtel Ltd (Bhartiartl - NSE) stay bearish when B over for C down in Y wave at around 565-70 with stops above 578.10 for target below 540 or even lower.

Eicher Motors Ltd (Eichermot - NSE) - Bullish or choppy - what’s next ?

Eicher Motors Ltd (Eichermot - NSE) has completed impulse wave since last low, so choppy to bearish corrective action expected. Stay short in B wave near 21200-400 with stops above 21735 for target in range of 20000 - 19700.

HDFC Bank Ltd (Hdfcbank - NSE) - Bullish but choppy price action

HDFC Bank Ltd (Hdfcbank - NSE) has completed A wave down and correcting in up move as B wave. B wave probably will unfold in abc zigzag so stay long above 1021.50 as stop loss for target zone of 1090 or higher.

Hcl Technologies Ltd (Hcltech - NSE) - stay long

Hcl Technologies Ltd (Hcltech - NSE) has extended 5th wave, so stay long if price gaps down near 692 as 4th subwave of 3rd of 5th wave, for new high as target around 725-35 zone. It sector itself is a stronger in last move and continue its gain.

Hero MotoCorp Ltd (Heromotoco - NSE) - Choppy but bullish price action

Hero MotoCorp Ltd (Heromotoco - NSE) It has completed W as abc correction and now going up to complete the X wave, so stay long in pull back after confirming the a wave in X cycle.

Housing Development Finance Corporation Ltd (HDFC - NSE) - Choppy

Housing Development Finance Corporation Ltd (HDFC - NSE) is Y wave as c down, gap down will end up the cycle or may make new low to end the cycle, after that stay long for bounce with stop loss below new low.

ICICI Bank Ltd (Icicibank - NSE) - choppy price action

ICICI Bank Ltd (Icicibank - NSE) is in X wave and will start c of X up so stay long with stop loss below b wave low 340.60 and target will be 362 or slight higher.

Indian Oil Corporation Ltd (IOC - NSE) - stay long

Indian Oil Corporation Ltd (IOC - NSE) has completed 2nd wave of C wave within ABC zigzag, so wait for confirmatory 1st wave of 3rd wave cycle, then stay long with stops below 87.30 for target of 103 or higher initially. Very good set up with high volume support.

IndusInd Bank Ltd (Indusindbk - NSE) - stay short

IndusInd Bank Ltd (Indusindbk - NSE) is in WXY, where W and X waves ended, while Y is in progress. It has completed A wave down in Y wave, so wait for B to over near 540-50 to sell it with stop loss above 560.35 for target below 480 or lower.

Mahindra & Mahindra Ltd (M&M - NSE) - Bullish to choppy bias

Mahindra & Mahindra Ltd (M&M - NSE) is in choppy WXY correction, where C of X wave is in progress, so stay long for new high, then probably it will correct down for Y wave.

Reliance Industries Ltd (Reliance - NSE) - choppy or bullish - what’s next ?

Reliance Industries Ltd (Reliance - NSE) is within 4th wave correction and b wave will go up. Wait for c to end for resuming up trend again. Trade is possible buy for b wave, sell for c wave down of 4th wave and finally buy for 5th wave.

To view the historical analyses of Nifty50 & stocks, click here.

"""Dear Admin,

ReplyDeleteI am Universal Investment Strategies. Very informative post! I am thankful to you for providing this unique information.

Universal Investment Strategies provides one-on-one options trading mentorship and education to investors seeking to generate active, passive and/or retirement income. With over 25 years of combined experience and thousands of satisfied customers, Universal Investment Strategies was founded on the principals of we will walk with you side by side every step of the way.

Universal Investment Strategies LOS ANGELES CA

Online Stock Trading

Best Options To Trade

Learn How To Trade Stocks

Best Trading Courses

Best Way To Learn Stock Trading"""